How Easy Can I Send Money From the Uk to America Using Pay Pal

Since launching close on 20 years ago, PayPal has played a big role in transforming ecommerce. Today, you can use your PayPal account to shop online, receive payments if you're a freelancer or entrepreneur, and send cash to family and friends.

If you're considering sending money abroad using your PayPal account, there are a few things you need to know about how to set up your international money transfer.

| 📝 Table of contents |

|---|

|

Sending money abroad? Wise could save you. A lot.

Banks and money transfer providers often give you a bad exchange rate to make extra profits.

Wise is different. Its smart new technology skips hefty international transfer fees by connecting local bank accounts all around the world. Which means you can save up to 6x by using Wise vs your bank when you send your money abroad.

Oh, and while you're at it, check out Wise's borderless multi-currency account. Where you can manage and send dozens of currencies, all from the same account.

Open your free Wise account now 🚀

Does PayPal work internationally?

Let's say you want to send money abroad – and you've been wondering: is PayPal international?

Yes, PayPal can be a useful tool for sending money internationally. And if you're going to send money abroad with PayPal, then it pays to know a little about the fees and charges you'll encounter along the way.

All the fees and charges discussed here relate to a PayPal USA account - if you're based elsewhere in the world, the costs might be slightly different. Check out the fees section of PayPal's local website, wherever you are, for more details.

PayPal international transfer fees

When you arrange an international transfer with PayPal, from a PayPal account based in the USA, you need to understand both the fee structure, and the currency conversion rate applied.

The international transfer fees you'll be charged depend on where you're sending money to - and how you fund the transfer. It's free to send money within the US and Canada to friends and family (except for card transfers).

But if you want to send cash to another country using either your PayPal balance, a linked bank account, or card it'll cost you 5.00% of the transaction amount. The fee in this case can range from $0.99-$4.99.¹

The international transfer fee is on top of the domestic transfer fee, which in case of card transfers is 2.90%+ a fixed fee based on the received currency.¹

See the PayPal most important international transfer fees on this table:

| PayPal Fees | |

|---|---|

| Domestic card fee | 2.90% + fixed fee based on currency¹ |

| Sending money using your Paypal balance or bank account | 5.00% (ranging from $0.99-$4.99)¹ |

| Sending money using your card | 5.00% (ranging from $0.99-$4.99)¹ |

💡 Find out all you need to know about PayPal's international transfer fees for the US - and how best to avoid them.

| If you need to make a business transfer, the Wise Business account is even up to 19x cheaper than PayPal for business use. |

|---|

PayPal conversion rate vs bank exchange rates

PayPal charges international transfer fees, but that's not all you need to know about. If you're sending money internationally, you'll also find that you pay a currency conversion spread of 4.00%¹, which is added onto the wholesale exchange rate.

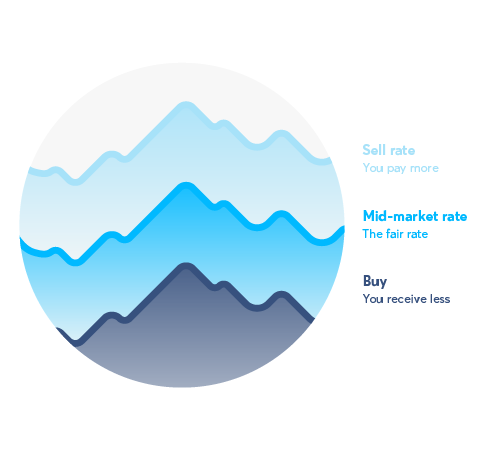

What that means, is that PayPal takes the exchange rate they get from a third party, and adds their conversion spread. You can see this if you compare the PayPal exchange rate with the mid-market rate, sometimes called wholesale, spot, or interbank rate.

It's the same rate you can find if you google USD (US dollars) along with the other currency involved in your international transfer. Exchange rates change all the time, but you can see the exchange rate that PayPal is offering you for your transfer, by logging into your PayPal account.

The mid-market rate is the only real exchange rate - it's what you'll find on Google, and the one that banks use to trade money on global financial markets. The difference between the mid-market rate and the one that PayPal offers, is another part of the profit they're making on that transaction.

Between this and the international transaction charges described above, you can find that the costs of making an international money transfer with PayPal mount up pretty quickly.

Here are some of the most common PayPal currency conversion fees:

| PayPal fees | |

|---|---|

| Currency conversion fees when sending money to a friend or family² | 4.00% or such other amount, which may be revealed during the transaction¹ |

| Currency conversion fees when sending paying for goods and services² | 4.00% or such other amount, which may be revealed during the transaction¹ |

| 💡 Want to learn more about PayPal's currency conversion rates? Read our article here. |

|---|

Sending money abroad: Alternatives to PayPal

If you decide against sending money abroad with PayPal, you have a couple of other options.

- Try a different money transfer service: which might be cheaper that PayPal

- Turn to your regular bank: which could be slower, but at least it's familiar

Try a different money transfer service

Looking for different money transfer services other than PayPal? Wise can actually save you a lot of money when sending money abroad – up to 6x. Let's see a real-life example of sending 1000 dollars with PayPal and Wise from the US to Canada:

Open your free Wise account now

If you frequently make cross-border payments, you also may consider signing up for the Wise borderless multi-currency account. You can also get the Wise multi-currency debit card, which you can use to pay for goods and services all over the world.

Make an international bank wire transfer

If you'd rather process your international money transfer - also known as a wire transfer - in person, then you can always call into your local bank. However, the costs of making an international transfer with your bank are a shock for many people.

The fees related to making a wire transfer online, or on the phone via your normal bank, are usually a little lower. That's if your bank even offers the service online. Check out the terms and conditions for your particular account before you commit.

Watch out for extra fees thanks to the SWIFT network

Unfortunately, if you choose to send your money via a traditional bank, they often won't be able to tell you exactly what your transfer will cost you if your transfer is processed using the SWIFT network.

The SWIFT network is how international transfers are passed from one bank to another, using a system of international protocols to make sure the money stays safe, and finds its way to the correct account in the end.

Banks all over the globe work together to complete the transaction - so there could be several intermediaries working on a single international transfer. Each of these banks take a fee of their own. These fees add up, and can mean that the recipient gets less money than you might expect, as it has been eroded by charges.

Alternatives like PayPal are convenient and simple to use - but while PayPal is great for local transfers and shopping online, the fees for international transactions are fairly high.

How to make an international money transfer with PayPal: Step-by-step

These are the steps you need to follow if you want to make an international transfer with PayPal:

- Log in to your PayPal account at PayPal.com.

- At the top menu next to the PayPal logo, select "Pay & Get Paid".

- Enter the name or email address of the recipient.

- Select the amount of money you'd like to send to the recipient and press "Continue". Here you should see the conversion rate of the exchange.

- If you haven't done it already, make sure to add a payment.

Other payment routes you may want to use

So, the guide above is what you need to follow when you want to send money quickly to friends and family. However, if you do decide to make an international money transfer with PayPal, you'll have a couple different options³ as well:

- Set up a home delivery of cash

- Make a direct bank deposit

- Have your recipient pick up the money you send from a participating location

Some of these services are delivered through Xoom³, which is a PayPal subsidiary specialising in certain types of payments and transfers. If you send cash to your recipient's PayPal wallet, then they'll need to have a PayPal account themselves to be able to access it. However, for the other options you can transfer cash via PayPal, even if the recipient doesn't have a PayPal account themselves.

| 💡 Note: Not all transfer options are available in all countries and currencies. |

|---|

Need more information? Check out these PayPal articles:

- PayPal: International Business Payments True Cost

- PayPal: Business Accounts

- PayPal: Invoicing Guide

- PayPal: Paying International Invoices Guide

- PayPal: Exchange Rates and Currency Conversion

- PayPal: International Fees (US)

- PayPal: International Fees (UK)

Sources

- PayPal consumer fees

- PayPal user agreement

- Send money abroad with PayPal

- Wise vs PayPal

All sources checked as of 12 November 2021

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

whitworthaltylets.blogspot.com

Source: https://wise.com/us/blog/paypal-international-money-transfer

0 Response to "How Easy Can I Send Money From the Uk to America Using Pay Pal"

Post a Comment